By Monsef Rachid | September 7, 2020 9:14 AM ET

Strong demand, low inventories prop up home prices in most U.S. cities

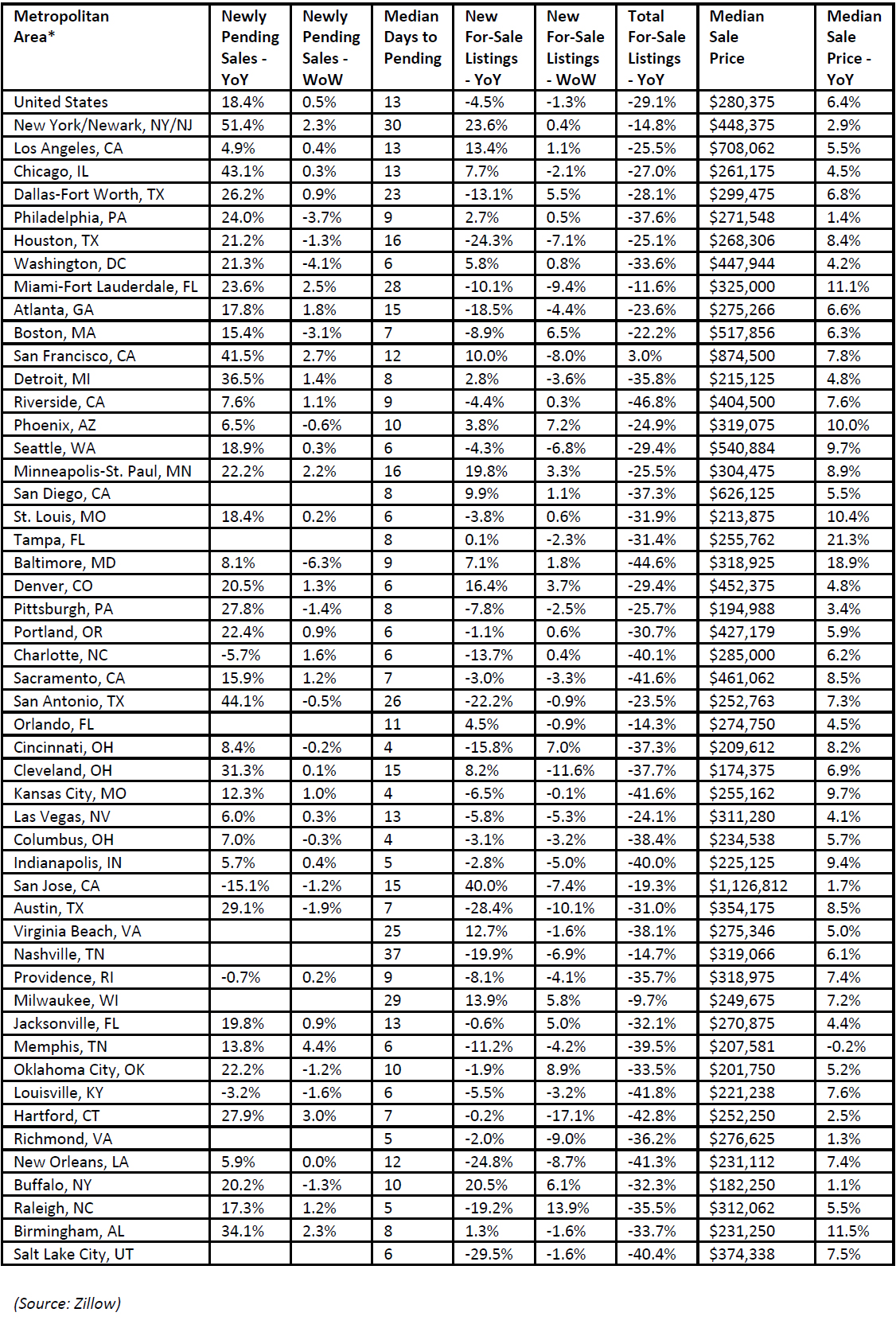

Based on new data by Zillow, U.S. home sellers continued to drive a housing market with low supply and eager buyers as total for-sale inventory contracted for the 13th straight week and typical time-on-market maintained record lows.

Typical homes on the market are more expensive as median list prices are up nearly 9% compared to last year. Buyers may see relief on the horizon, however, as new for-sale inventory rose month-over-month and is closer to last-year’s figures than any time since March.

Days-to-pending match August lows; newly pending sales stabilize high above last year

- As has been the case for the past three weeks, homes are typically going under contract 13 days after they’re listed. This is two weeks faster than a year ago and the shortest median time on market in Zillow’s weekly records going back through January 2019.

- Newly pending sales are up 18.4% compared to last year; the highest year-over-year gain since November 2019. The level is holding steady, with no change compared to a month ago, and only a slight increase (0.5%) week over week.

For-sale inventory continues to tighten, though new listings may provide relief

- New sellers may help sate rapid demand as new for-sale inventory rose 3.5% compared to a month prior. The number of new listings is nearly back to normal for this time of year; at just 4.5% below the same week in 2019, the year-over-year gap is the smallest seen since March.

- Inventory continues a long contraction that began the first week of June. Total for-sale inventory is down 29.1% year over year, the largest yearly deficiency since at least January 2019. For-sale inventory is down 3.6% month over month and is slightly tighter than the previous week (-0.8%).

List prices skyrocket over last year

- Sellers are clearly in the driver’s seat as median list prices grew to $345,722. The 8.9% rise in list price compared to last year is the largest year-over-year increase since at least January 2019.

- Median sale price the week ending July 18 was $280,375, which was 6.4% higher than last year. The month-over-month median sale price increase of 4.6% was second in size only to the week prior in records going back through January 2019 (the week ending July 11 posted a 5% month-over-month increase).

- The share of listings with a price cut held steady at 4.2%, which is 1.4 percentage points lower than a year ago.

Eviction moratorium extended through December and mortgage rates fall again

- The Centers for Disease Control and Prevention put forward an order to bar evictions for most renters through December 31. The previous eviction moratorium under the CARES Act expired July 24, although landlords could not begin eviction proceedings for 30 days.

- Mortgage rates fell again this week, trending toward record lows seen in early August, following the Federal Housing Finance Agency’s announcement last week that a 0.5% price adjustment on some refinances will be delayed until December https://www.worldpropertyjournal.com/real-estate-news/united-states/tampa-real-estate-news/real-estate-news-zillow-housing-reports-rising-home-price-data-coronavirus-impact-on-home-sales-august-2020-median-home-prices-12115.php